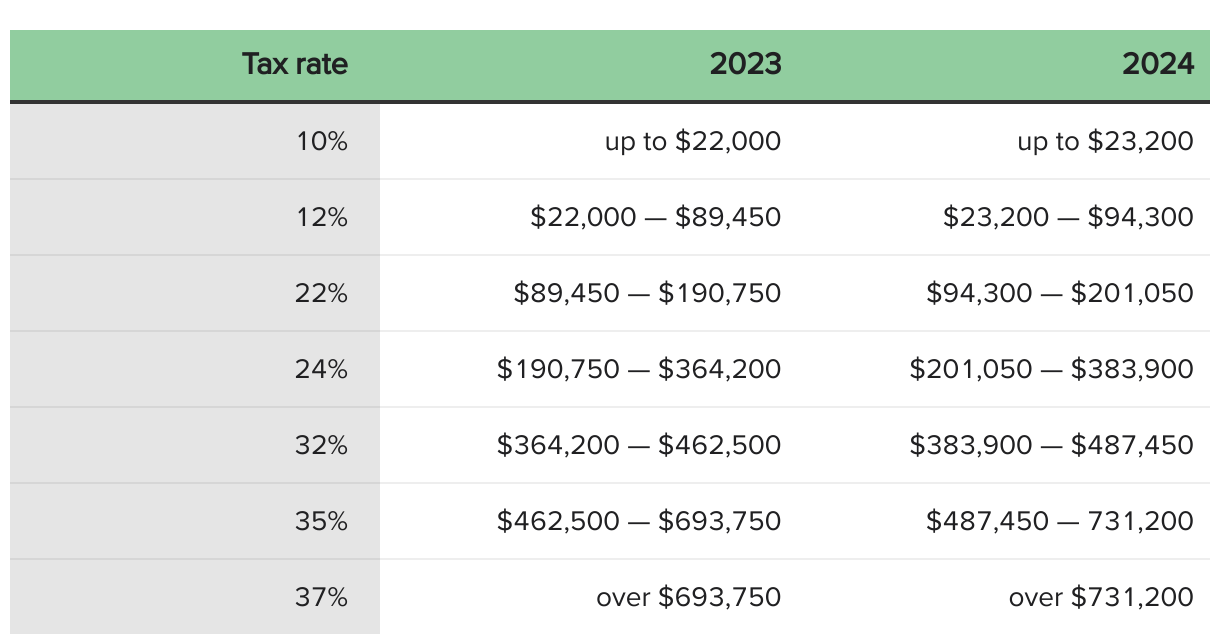

Tax Brackets For 2024 Single Person – There are seven federal income tax rates for 2023 and 2024: 10%, 12%, 22%, 24%, 32%, 35% and 37%, depending on your taxable income and filing status. . Your tax bill is largely determined by tax brackets. These are really just ranges of taxable income. As your taxable income moves up this ladder, each layer gets taxed at progressively higher rates. .

Tax Brackets For 2024 Single Person

Source : www.benefitandfinancial.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

2023 2024 Tax Brackets and Federal Income Tax Rates | Bankrate

Source : www.bankrate.com

New IRS tax brackets take effect in 2024, meaning your paycheck

Source : www.fox10phoenix.com

The IRS will soon set new tax brackets for 2024. Here’s what that

Source : www.cbsnews.com

Federal Tax Income Brackets For 2023 And 2024

Source : thecollegeinvestor.com

2023 2024 Tax Brackets & Federal Income Tax Rates – Forbes Advisor

Source : www.forbes.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

Capital Gains Tax Brackets For 2023 And 2024

Source : thecollegeinvestor.com

2024 Tax Brackets: IRS Reveals New Income Thresholds | Money

Source : money.com

Tax Brackets For 2024 Single Person Kick Start Your Tax Planning For 2024: Taxpayers saw their tax refunds shrink last year due to the expiration of pandemic benefits. But some people may get a boost in 2024. . As the calendar turns to 2024, You’re about to increase your take-home pay without getting a raise. The IRS put in place higher limits for federal income tax brackets this year, which means Americans .